Published on: July 2, 2025

Author: Realty in Tyler Team

As we move through mid-2025, the real estate market—both nationally and right here Lake Palestine is once again shifting. One of the most critical factors influencing buying and selling decisions today is mortgage interest rates. Whether you’re a first-time buyer, an investor, or thinking about listing your home, understanding where rates stand and where they’re headed can help you make informed choices.

📈 Where Mortgage Rates Stand Now (Summer 2025)

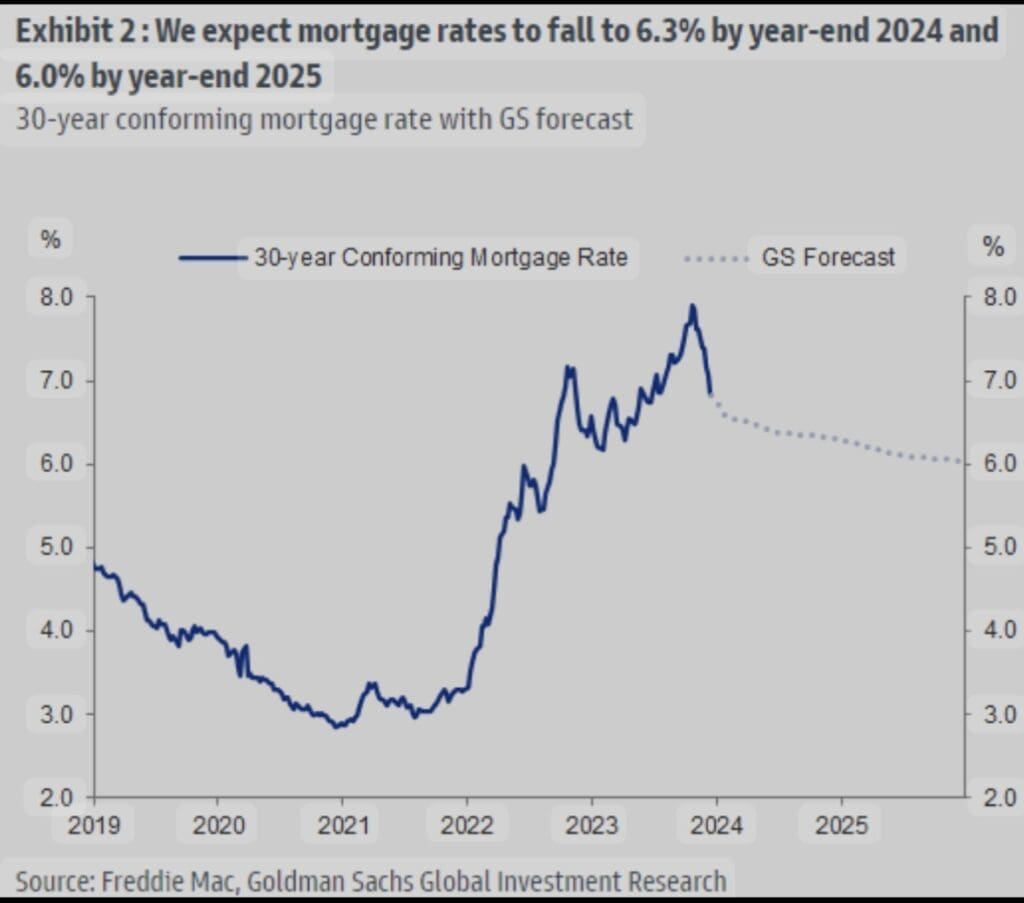

As of July 2025, the average 30-year fixed mortgage rate is hovering around 6.75% to 7.10%, depending on credit score, loan size, and lender. This is slightly down from late 2024, when rates peaked at over 7.5%, but still considerably higher than the historic lows we saw in 2020–2021.

Here’s a quick breakdown of current average mortgage rates:

- 30-Year Fixed: 6.75% – 7.10%

- 15-Year Fixed: 6.15% – 6.45%

- FHA/VA Loans: Slightly lower, often under 6.5% with favorable terms

- 5/1 ARMs: Around 6.25%, though riskier for long-term planning

Mortgage Rate Influencers

🔍 What’s Driving Mortgage Rates?

Several key factors are influencing interest rates this year:

- Federal Reserve Policy: While the Fed has begun gradually lowering interest rates to stimulate borrowing, it is moving cautiously due to persistent inflation concerns.

- Inflation: Although inflation has cooled from its peak, it’s still above the Fed’s 2% target, which is keeping borrowing costs higher than pre-pandemic norms.

- Economic Growth: A mixed bag of economic indicators—including slower job growth and consumer spending—has added uncertainty to rate forecasts.

🧭 Where Are Rates Headed?

Most analysts expect modest rate declines through the end of 2025, potentially bringing the average 30-year fixed rate down into the 6.25%–6.50% range. However, this is far from guaranteed, and several “wild cards” could keep rates elevated:

- Sticky inflation

- Unexpected global or domestic economic shocks

- Changes in Federal Reserve policy

If you’re waiting for rates to “drop significantly” before buying or refinancing, it may be a long wait.

🏠 What This Means for Buyers Looking for Homes on Lake Palestine

Lake Palestine continues to see steady demand, especially from buyers relocating from larger metro areas. But higher mortgage rates have reduced affordability for many. If you’re house hunting in 2025:

- Get pre-approved early to lock in a rate and strengthen your offers.

- Consider buydowns or adjustable-rate mortgages if you expect to refinance in a few years.

- Work with a local expert (like our team at Realty in Tyler) to find value in a competitive market.

📉 What This Means for Sellers

Higher rates mean fewer qualified buyers, which can slow down the selling process. That said, inventory of Homes on Lake Palestine remains relatively tight, so:

- Pricing your home accurately is more important than ever.

- Offering rate buydown incentives or closing cost assistance can attract buyers.

- Move-up buyers may be more cautious, so expect longer decision cycles.

Lake Palestine Homes

💬 Final Thoughts

While the days of 3% mortgages are likely behind us for the foreseeable future, the Lake Palestine real estate market remains active and resilient. Whether you’re buying or selling, staying informed—and working with a knowledgeable local agent—can make all the difference.

If you’re curious about your options in the current market, reach out to the RealtyinTyler team today. We’re happy to help you navigate every step of your real estate journey.

Need help getting pre-approved or evaluating your home’s market value?

📞 Call us at [903 574-1466]

📧 Email: [Kevin@RealtyInTyler.com]

🌐 Visit: https://realtyintyler.com